Contractor paycheck calculator

Now you can easily create a Form W-4 that reflects your planned tax withholding amount. You are a member of a partnership that carries on a trade or business.

Gross Pay And Net Pay What S The Difference Paycheckcity

6 to 30 characters long.

. Clients using a TDDTTY device. The calculator is updated with the tax rates of all Canadian provinces and territories. Their employer withholds taxes from each paycheck and sends the money to the federal and sometimes state government.

Government in 2021 with 13916 employed. How Your Tennessee Paycheck Works. North Dakota Paycheck Calculator.

This page shows a list of stories andor poems that this author has published on Literotica. These calculators are not intended to provide tax or legal advice and do not represent any. Important note on the salary paycheck calculator.

Find payroll and retirement calculators plus tax and compliance resources. Important note on the salary paycheck calculator. The most common payscale was the general schedule payscale.

Contractor was the 26th most popular job in the US. Paycheck Protection Program Guide. This is a lot of money so make sure to look for all the deductions or credits you can find during tax time.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Paycheck Protection Program PPP Loan Calculator.

Usage of the Payroll Calculator. SEM may incorporate search engine optimization SEO which adjusts or rewrites website content and site architecture to achieve a higher ranking in search engine. The amount can be hourly daily weekly monthly or even annual earnings.

These calculators are not intended to provide tax or legal advice and do not represent any. So for example if your paycheck is 30000 and 10000 is taken from your paycheck for mandatory tax deductions this leaves 20000 in eligible income for your past due child support garnishments to be deducted from. The tax calculator below allows you to estimate your share of the first Coronavirus Crisis related stimulus payments issued to most American taxpayers or residents.

Search engine marketing SEM is a form of Internet marketing that involves the promotion of websites by increasing their visibility in search engine results pages SERPs primarily through paid advertising. Then enter the employees gross salary amount. States you have to pay federal income and FICA taxes.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. These boxes on the W-2 provide all the identifying information related to you and your employer. Enter your pay rate.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Government Contracting jobs are classified under the General Schedule GS payscale. What are My Self-Employed Tax Obligations.

Whether a person is an employee or an independent contractor a certain percentage of gross income will go towards FICA. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. While your employer typically covers 50 of your FICA taxes this is not the case if you are a self-employed worker or an independent contractor.

These calculators are not intended to provide tax or legal advice and do not represent any. Attend webinars or find out where and when we can connect at in-person. Exempt means the employee does not receive overtime pay.

It should not be relied upon to calculate exact taxes payroll or other financial data. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimatesIt should not be relied upon to calculate exact taxes payroll or other financial data. In 2021 the Veterans Health Administration hired the most employees titled Contracting with an average salary of 86634.

To access paystubs and tax forms prior to October 8 2021. Must contain at least 4 different symbols. Paycheck deductions begin approximately 30 days after you receive your first paycheck.

Employees have it relatively easy when it comes to paying taxes. Tax forms and the pay planning calculator electronically. Clients using a relay service.

Every pay period payroll taxes are deducted from an employees gross pay. Important note on the salary paycheck calculator. There is actually a deduction designed to help self-employed.

As is the case in all US. If you did not receive this payment you can claim the money via the Recovery Rebate Credit on your 2020 Tax Return which was due on October 15 2021. It should not be relied upon to calculate exact taxes payroll or other financial data.

If your situation requires you to pay the maximum 65 on this eligible 20000 then your child support garnishment would be. Find a Local Branch or ATM. It can also be used to help fill steps 3 and 4 of a W-4 form.

ASCII characters only characters found on a standard US keyboard. In this case you are responsible for ensuring that 100 of your FICA taxes are. You carry on a trade or business as a sole proprietor or an independent contractor.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Diversity Equity Inclusion Toolkit. You can use the calculator to compare your salaries between 2017 and 2022.

2021 2022 Paycheck and W-4 Check Calculator. Payroll taxes vary based on an employees wages. These calculators are not intended to provide tax or legal advice and do not represent any.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. This table shows the top 5 industries in California by number of loans awarded with average loan amounts and number of jobs reported. Youll see your social security number Box A name Box E and address Box F appear here while your employers employer identification number EIN Box B name and address Box C and control number Box D if any appear here as well.

Compensation paid to an employee in excess of an annual salary of 100000 andor any amounts paid to an independent contractor or sole proprietor in excess of 100000 per year. Important note on the salary paycheck calculator. You are otherwise in business for yourself including a part-time business or a gig worker.

Contractor Resources Access to everything youll need as a contract employee of Populus Group. Tax Guides. California has a total of 1271195 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration.

It should not be relied upon to calculate exact taxes payroll or other financial data. They also include a combination of federal state and local tax rates that can change from year to year. If youre self-employed or an independent contractor youre responsible for covering the full amount of your FICA taxes on your own.

Employees usually pay half of their payroll taxes out of each paycheck while their employer pays the other half.

Multiple Employee Timesheet Templates

Overtime Pay Calculators

Consultants Vs True Cost Of Employees Calculator Toptal

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Gross Pay Definition What It Is How To Calculate It Sage Advice Us

Consultants Vs True Cost Of Employees Calculator Toptal

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Overtime Pay Calculators

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Formula

Overtime Pay Calculators

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

Paycheck Calculator Online For Per Pay Period Create W 4

Payroll Calculator Free Employee Payroll Template For Excel

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

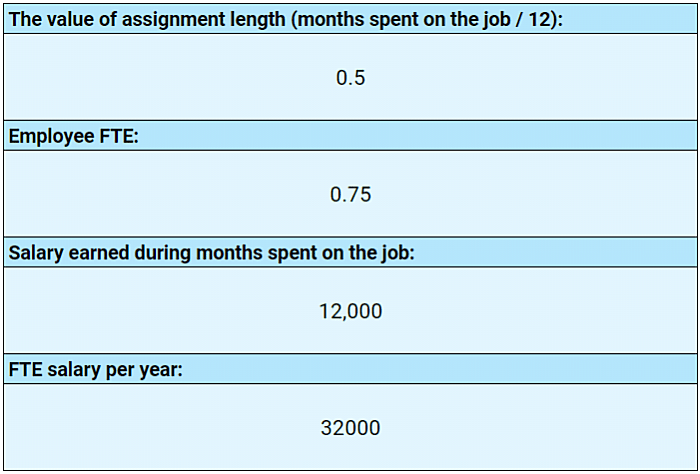

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog